Effectively managing your business’s finances provides you with the data necessary to keep your business growing while helping you maximize your bottom line. This article includes some beneficial tips and strategies to aid you in successfully managing your finances.

Keep Your Balance Sheet Up-to-Date

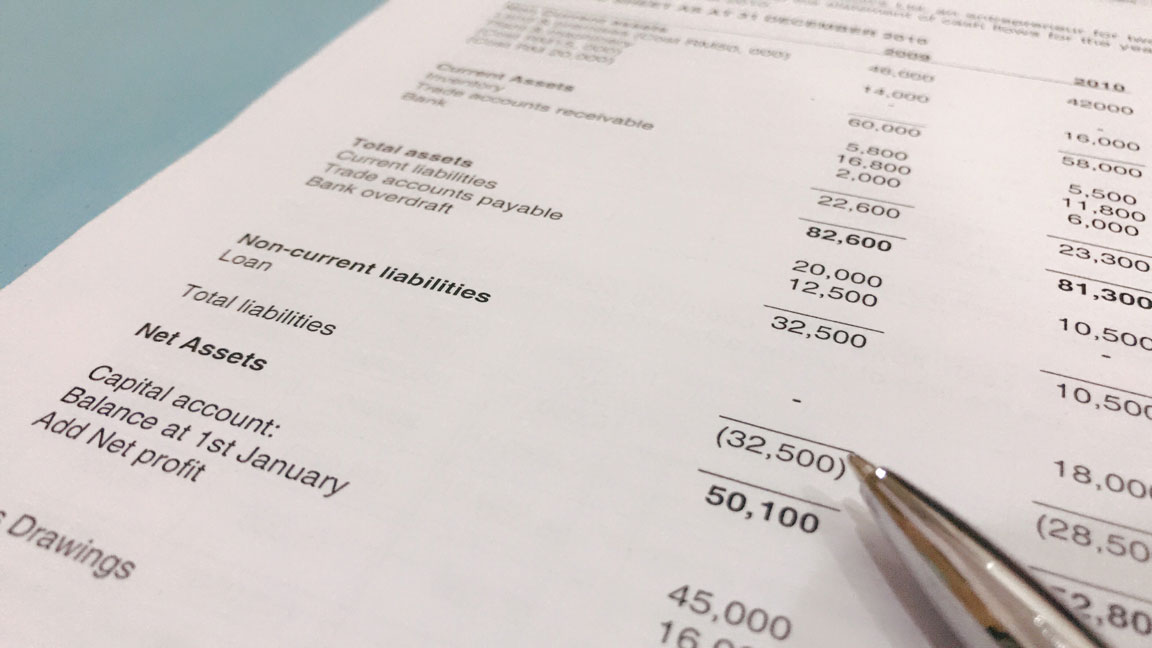

Keeping an up-to-date and accurate balance sheet is a crucial aspect of managing your business’s finances. Your balance sheet helps you track cash flow pertaining to:

- Assets

- Liabilities

- Equity

Additionally, a well-managed balance sheet helps you prepare for the future and enables you to develop a cost-benefit analysis.

Cost-Benefit Analysis (CBA)

Looking closely at money-in and money-out helps maintain a sustainable balance between profit and loss. From development and operations to recurring and nonrecurring costs, it’s important to categorize expenses in your balance sheet. Then, you can use a cost-benefit analysis, or a process that helps weigh the strengths and weaknesses of a business decision, and put potential recurring benefits and cost reductions in context.

A CBA is a technique for making non-critical choices in a relatively quick and easy way. It simply involves adding money in benefits and money in costs over a specified time period, before subtracting costs from benefits to determine success in terms of dollars. This can come in handy with hiring another employee or an independent contractor.

For example, let’s say you’re deciding whether to add outdoor seating for your sausage themed restaurant, Haute Dog. You estimate outdoor seating would add $5,000 in extra profit from sales each year. But, the outdoor seating permit costs $1,000 each year, and you’d also have to spend $2,000 to buy outdoor tables and chairs. Your cost-benefit analysis shows that you should add outdoor seating, because the new benefits ($5,000 in new sales) outweigh the new costs ($3,000 in permitting and equipment expenses).

Accounting Methods

The two primary accounting methods businesses apply are accrual and cash. However, each of these methods has its pros and cons. In short, accrual accounting instantly enters transactions once a sale is complete; cash accounting inputs the transaction when the money is actually received. Cash accounting is easier but provides less financial insight. Accrual accounting may help you save on your taxes and provide more well-rounded financial data but tends to contain short-term inaccuracies and uses more time and resources. Depending on the complexities of your business’s finances, you may want to consult a CPA on which method is suitable for you.

Note: Any company with $25 million or more in yearly sales must use accrual accounting as it adheres to Generally Accepted Accounting Principles (GAAP).